Not known Details About Hard Money Atlanta

Wiki Article

8 Easy Facts About Hard Money Atlanta Shown

Table of ContentsHard Money Atlanta - The FactsThe Of Hard Money AtlantaA Biased View of Hard Money AtlantaOur Hard Money Atlanta DiariesAbout Hard Money Atlanta

In many locations, rate of interest rates on difficult cash loans range from 10% to 15%. Additionally, a consumer might require to pay 3 to 5 points, based on the complete financing quantity, plus any type of suitable evaluation, evaluation, and administrative charges. Lots of tough money lending institutions need interest-only payments throughout the brief duration of the funding. hard money atlanta.Hard money loan providers make their cash from the passion, factors, and charges charged to the borrower. These lending institutions seek to make a quick turn-around on their financial investment, therefore the higher rate of interest as well as much shorter regards to difficult money lendings. A tough cash lending is an excellent concept if a consumer needs cash promptly to purchase a home that can be rehabbed and also flipped, or rehabbed, rented out and also refinanced in a relatively short duration of time.

The smart Trick of Hard Money Atlanta That Nobody is Talking About

For personal financiers, the finest part of getting a hard money finance is that it is easier than getting a traditional mortgage from a bank. The authorization procedure is normally much less extreme. Banks can request for a nearly endless series of documents as well as take several weeks to months to obtain a loan approved.The primary purpose is to make certain the customer has a departure technique and also isn't in monetary ruin. However lots of difficult money lenders will certainly deal with people who don't have fantastic credit rating, as this isn't their greatest problem. The most important point difficult money loan providers will check out is the investment building itself.

How Hard Money Atlanta can Save You Time, Stress, and Money.

However there is an additional benefit developed into this procedure: You obtain a 2nd set of eyes on your deal and also one that is materially bought the task's result at that! If a deal misbehaves, you can be rather positive that a tough money loan provider won't touch it. However, you must never utilize that as a justification to discard your own due diligence.The finest place to look for hard cash lending institutions is in the Bigger, Pockets Tough Cash Loan Provider Directory or your local Property Investors Association. her explanation Remember, if they have actually done right by one more financier, they are most likely to do right by you.

Review on as we go over hard cash financings as well as why they are such an attractive alternative for fix-and-flip investor. One significant advantage of hard cash for a fix-and-flip investor is leveraging a relied on loan provider's dependable resources as well as speed. Leveraging ways using other individuals's cash for investment. Although there is a threat to financing an acquisition, you can free up your very click here for more info own money to acquire more residential or commercial properties.

Things about Hard Money Atlanta

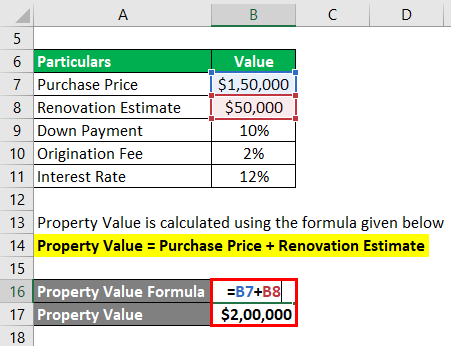

You can take on projects incrementally with these tactical financings that permit you to rehab with just 10 - 30% down (depending on the lender). Hard money car loans are normally temporary financings used by investor to money solution and also flip residential or commercial properties or other realty investment bargains. The home itself is utilized as collateral for the funding, as well as the high quality of the property bargain is, as a result, a lot more crucial than the debtor's creditworthiness when getting the finance.Nevertheless, this likewise means that the risk is greater on these fundings, so the rates of interest are generally greater as well. Fix and also flip capitalists select hard cash because the marketplace doesn't wait. When the possibility provides itself, and you're all set to get your task into the rehabilitation phase, a tough money loan obtains you the cash straightaway, pending a reasonable assessment of business deal.

Inevitably, your terms will depend on the difficult cash lending institution you choose to work with as well as your special circumstances. Many difficult money lending institutions run in your area or just in particular regions.

The Ultimate Guide To Hard Money Atlanta

Intent as well as building documents includes your thorough extent of job (SOW) as well as insurance (hard money atlanta). To assess the residential or commercial property, your lender will certainly consider the worth of similar residential properties in the area and their estimates for development. Complying with an estimate of the property's ARV, they will certainly fund an agreed-upon percentage of that worth.This is where your Range of Job (SOW) comes right into play. Your SOW is a file that details the job you intend to perform at the building as well as is generally called for by a lot of hard cash loan providers. It consists of improvement prices, obligations of the events included, and, commonly, a timeline of the deliverables.

For instance, allow's assume that your building doesn't have actually a finished cellar, but you are preparing to finish it per your range of job. Your ARV will certainly be based on the offered rates of comparable houses with ended up basements. Those costs are most likely to be higher than those of houses without ended up basements, therefore enhancing your ARV as well as potentially qualifying you for a greater loan quantity. hard this website money atlanta.

Report this wiki page